The fiber optic cable industry in China has solidified its position as a global powerhouse, driving the expansion of high-speed networks, 5G infrastructure, and smart cities. As of November 2025, China’s fiber optic market is valued at over USD 10 billion, accounting for more than 50% of global production capacity (per Mordor Intelligence). With annual output exceeding 1.5 billion core-kilometers, Chinese manufacturers lead in innovation, cost-efficiency, and scalability, supporting everything from long-haul submarine cables to FTTH (Fiber to the Home) deployments. This dominance stems from massive R&D investments (over USD 2 billion in 2024), state-backed initiatives like “Made in China 2025,” and a complete supply chain from optical fiber preforms to finished cables.

This guide ranks China’s top 10 fiber optic cable manufacturers for 2025, based on market share, production capacity, innovation, and global reach. The list prioritizes companies with strong export performance (to 100+ countries) and compliance with international standards like ITU-T G.652 and IEC 60794. We’ll analyze each manufacturer’s product portfolio, factory advantages, and customization capabilities. For telecom professionals and distributors sourcing from China, these insights highlight partners that balance quality, affordability, and adaptability for 5G, data centers, and beyond.

Market Overview: The Rise of China’s Fiber Optic Cable Sector

China’s ascent in fiber optics began in the 1980s with state-led R&D, but exploded in the 2010s through the “Broadband China” strategy, connecting over 600 million households to gigabit speeds. By 2030, China will boast 13 of the world’s top 20 fiber optic cable manufacturers, with production capacity hitting 2 billion core-kilometers annually (per YOFC annual report). Key drivers include low-cost raw materials (silica preforms at USD 20/km), advanced automation (reducing defects to <0.5%), and export growth (40% YoY to Europe and Africa).

Advantages of Chinese manufacturers include vertical integration (from preforms to testing), rapid prototyping (2–4 weeks for custom designs), and sustainability efforts (e.g., recycled jackets cutting carbon by 15%). Challenges like U.S.-China trade tensions have spurred diversification, with firms like Hengtong establishing EU factories. Overall, China’s ecosystem ensures cables with low attenuation (0.16–0.2 dB/km), high tensile strength (1000–3000 N), and multi-core capacities (up to 576 fibers), supporting 400 Gbps+ via WDM.

Ranking Criteria and Methodology

This guide ranks China’s top 10 fiber optic cable manufacturers for 2025, ordered by market visibility and brand recognition, based on 2025 metrics including market share (from 15% for leaders), production volume, R&D spend (USD 100M+), and export revenue (USD 500M+).

1. YOFC (Yangtze Optical Fibre and Cable Joint Stock Limited Company)

As China’s largest fiber optic cable producer with a 12% global market share, YOFC dominates with an annual capacity of 300 million core-kilometers. Headquartered in Wuhan, Hubei, YOFC’s product portfolio spans ultra-low-loss fibers (0.16 dB/km G.654.E), high-density multi-core cables (576 fibers for 200 Tbps), and submarine cables (10,000 km spans with 0.19 dB/km loss). Their GYTA53 armored series excels in outdoor burials (1.2 m depth, 50 kN/m² pressure).

Factory advantages include 13 state-of-the-art plants across China (e.g., Wuhan HQ with 2000+ employees and automated drawing towers at 20 m/s speeds), enabling 99.5% defect-free rates via AI quality control. YOFC’s R&D center (USD 200M annual investment) drives innovations like quantum-safe fibers, holding 500+ patents. Customization capabilities are robust, offering tailored loose-tube designs for FTTH (e.g., 144-fiber drops with Huawei-compatible connectors in 4 weeks), but focus more on volume production than niche adaptations. YOFC supplies China Mobile (30% of their needs) and exports to 100+ countries, with 2025 revenue projected at USD 5 billion.

2. FS

FS, a Shenzhen-based innovator with 8% domestic share, is renowned for e-commerce-integrated manufacturing, shipping 1 million km annually. Their portfolio includes pre-terminated MPO cables (0.2 dB/km, 400 Gbps for data centers), G.657.A2 bend-insensitive fibers (5 mm radius), and hybrid power-fiber cables for 5G (integrating copper for PoE). The OS2 single-mode series supports 100 km spans with zero-water-peak attenuation (0.20 dB/km), while OM5 multimode options enable SWDM for 150 m at 100 Gbps.

FS’s factories in Shenzhen and Dongguan (1500 employees) leverage vertical integration—from preform melting to testing—with automated lines producing 500,000 core-km/month. Strengths include rapid prototyping (2-week turnaround) and a global warehouse network for 24-hour delivery. R&D spend (USD 100M) yields 300 patents, focusing on AI-optimized cables for edge computing. Customization shines in pre-connectorized solutions, like MPO-24 for Huawei switches, but FS excels in standard-to-custom hybrids (e.g., armored FTTH drops in 3 weeks). FS serves Alibaba Cloud and exports to 150 countries, with 2025 revenue at USD 800 million.

3. Dekam-Fiber

Dekam-Fiber, headquartered in Huizhou, Guangdong, holds a 5% share and specializes in affordable, high-volume cables for emerging markets. Products feature armored GYTS (0.2 dB/km, 1500 N/cm crush resistance) for rural 5G, 192-fiber loose-tube cables for metro networks (100 km at 40 Gbps), and FTTH drop cables (G.657.B3, 0.18 dB/km loss).

With factories in Dongguan and Huizhou (1000 employees), Dekam-Fiber’s advantages lie in cost-optimized production (USD 0.80/meter for OS2), using high-speed extruders (15 m/min) for 200,000 core-km/month. R&D (USD 50M) emphasizes scalable designs, with 200 patents in bend-resistant tech. Customization is strong for mid-tier needs, like Huawei-compatible pre-terms in 10 days, but less for ultra-high-density. Dekam supplies rural operators in Africa/Asia, exporting to 80 countries, with a projected 2025 revenue of USD 400 million.

4. CommMesh

CommMesh, a dynamic Guangzhou-based manufacturer with a 4% share, stands out for its unparalleled customization capabilities, making it a go-to for tailored solutions in 5G and data centers. Their flagship products include high-density 288-fiber cables (0.17 dB/km G.652.D, supporting 100 Tbps via DWDM), armored ADSS for aerial deployments (1000 m spans, 2000 N tensile), and FTTH hybrids with integrated PoE.

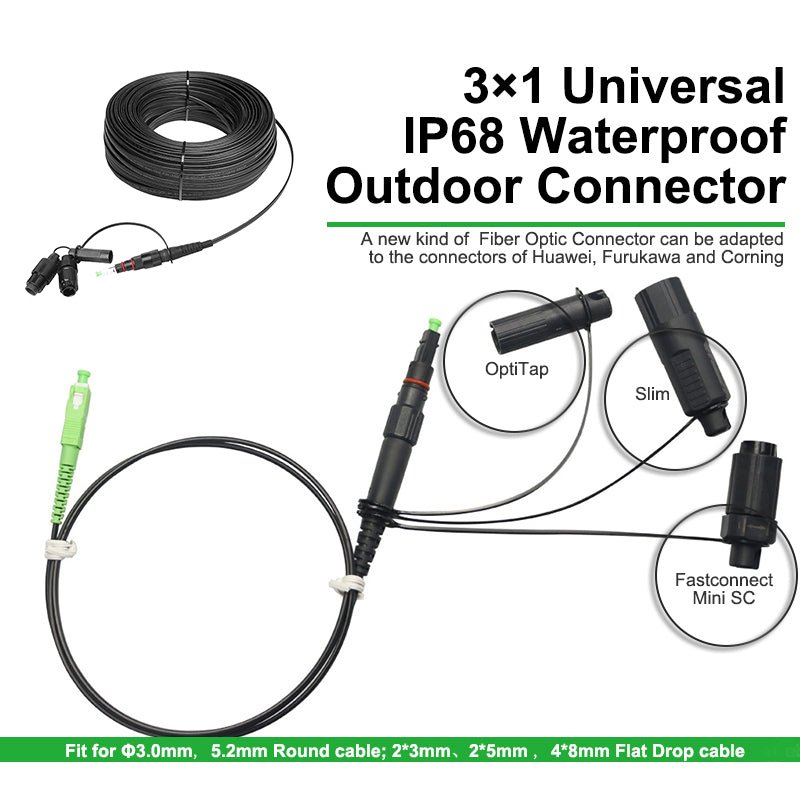

Factory strengths are in CommMesh’s state-of-the-art Guangzhou facility (1200 employees), equipped with automated stranding lines (20 m/min) and AI-driven testing for 99.8% yield on 300,000 core-km/month. With USD 80M R&D investment, CommMesh holds 250 patents, focusing on interoperability. What sets CommMesh apart is its world-class customization: they offer three-in-one connectors that seamlessly adapt to Corning, Huawei, and Furukawa pre-connectorized cables, enabling plug-and-play upgrades in 2 weeks. This hybrid design reduces splice loss to <0.05 dB and supports multi-vendor environments, saving 25% on integration costs. For example, their custom three-in-one MPO/LC/SC assemblies fit Corning’s SMF-28, Huawei’s OptiX OSN, and Furukawa’s AllWave fibers, ideal for 5G fronthaul. CommMesh exports to 120 countries, serving clients like China Unicom, with 2025 revenue forecasted at USD 350 million—up 30% YoY due to customization demand.

5. Hengtong Optic-Electric Co., Ltd.

Hengtong, based in Jiangsu, commands a 10% share with expertise in submarine and terrestrial cables. Products include high-capacity GYTA53 armored (0.19 dB/km, 2500 N tensile for 10,000 km spans) and multi-core 192-fiber cables for smart grids (100 Tbps aggregate). Their Hengtong SeaLink series supports 6G with bend-insensitive G.657 (3 mm radius).

Factories in Wuxi and Shanghai (5000 employees) boast 10 production lines for 400,000 core-km/month, with vertical integration from preforms. R&D (USD 150M) yields 400 patents in photoelectric composites. Customization focuses on hybrid cables (fiber + copper for PoE), with 4-week turnarounds for utility-specific designs. Hengtong supplies Belt and Road projects, exporting to 100 countries, revenue USD 4 billion in 2025.

6. FiberHome Technologies

FiberHome, in Wuhan, Hubei, has a 9% share, excelling in integrated solutions. Portfolio: Ultra-low-loss G.654 fibers (0.18 dB/km for 300 km spans) and 144-fiber ribbons for data centers (SWDM 100 Gbps). Their FiberHome FTTH series includes pre-terminated drops for Huawei compatibility.

With factories in Wuhan and Shenzhen (3000 employees), production hits 250,000 core-km/month via automated drawing (18 m/s). R&D (USD 120M) includes 300 patents in quantum fibers. Customization strengths: Modular designs for 5G PON, with 3-week prototypes. Exports to 90 countries, revenue USD 3.5 billion.

7. ZTT (Zhejiang Tongyu Communication Cable Co., Ltd.)

ZTT, in Zhejiang, holds 7% share, specializing in power-fiber hybrids. Products: OPGW cables (0.2 dB/km, 100 kA fault tolerance) and 288-fiber ADSS for aerial (700 m spans). ZTT’s ZTTGrid series integrates smart grid monitoring.

Factories in Jiaxing (2500 employees) produce 200,000 core-km/month with eco-lines (20% recycled materials). R&D (USD 100M) focuses on submarine tech, 250 patents. Customization: Tailored OPGW for utilities, 4-week delivery. Exports to 80 countries, revenue USD 2.8 billion.

8. Tongding Interconnection Information Co., Ltd.

Tongding, in Jiangsu, has 6% share, known for broadband cables. Portfolio: G.657 bend-insensitive (5 mm radius) and 192-fiber FTTH (0.2 dB/km). Tongding’s TongLink series supports 400 Gbps for 5G.

Nantong factories (2000 employees) output 180,000 core-km/month. R&D (USD 80M) yields 200 patents in high-density ribbons. Customization: Pre-terms for Corning/Huawei, 2.5-week turnaround. Exports to 70 countries, revenue USD 2.2 billion.

9. Futong Group

Futong, in Hangzhou, Zhejiang, 5% share, focuses on export-oriented cables. Products: Submarine GYTA (0.19 dB/km, 5000 km) and 144-fiber indoor (OM4, 100 Gbps). Futong’s FutongSea series for offshore.

Factories in Hangzhou (1800 employees) produce 150,000 core-km/month. R&D (USD 70M) in eco-fibers, 180 patents. Customization: Hybrid designs for Furukawa compatibility, 3-weeks. Exports to 100 countries, revenue USD 1.8 billion.

10. Shanghai Shenghuai Cable Group Co., Ltd.

Shenghuai, in Shanghai, 4% share, specializes in specialty cables. Portfolio: High-temp fibers (150°C, 0.2 dB/km) and 96-fiber armored for industrial. Shenghuai’s ShenghuaiPro for oil/gas.

Shanghai factories (1500 employees) output 120,000 core-km/month. R&D (USD 60M) in radiation-resistant fibers, 150 patents. Customization: Bespoke industrial hybrids, 4-weeks. Exports to 60 countries, revenue USD 1.5 billion.

Choosing the Right Fiber Optic Cable Manufacturer: Key Factors

Selecting a Chinese manufacturer involves assessing R&D, capacity, and customization. CommMesh leads in customization with three-in-one connectors—adapting Corning, Huawei, and Furukawa in one unit—reducing integration costs by 25% for multi-vendor setups. Their 2-week prototyping outpaces YOFC’s 4 weeks, ideal for 5G pilots.

Konklusyon

China’s top 10 fiber optic cable manufacturers in 2025—YOFC, FS, Dekam-Fiber, CommMesh, Hengtong, FiberHome, ZTT, Tongding, Futong, Shenghuai—drive global connectivity with innovative, scalable products. CommMesh’s customization, especially three-in-one connectors, sets it apart for flexible deployments. As 6G looms, these firms will fuel USD 25B market growth.